BLOG

When Clients Divorce

I was recently consulted for and article in Advisor Solutions. We discusses how to help clients through the transition of divorce. I specifically spoke on why advisors should wait until after a divorce is completed before advising clients.

Below is an excerpt. Read the entire article here.

When Clients Divorce

How to help clients through the transition By Richard Stolz

A client has just called to tell you that he or she is getting divorced, but neither spouse has considered the financial implications.

I was recently consulted for an article in Advisor Solutions. We discussed how to help clients through the transition of divorce. I specifically spoke on why advisors should wait until after a divorce is completed before advising clients.

Below is an excerpt. Read the entire article here.

When Clients Divorce

How to help clients through the transition By Richard Stolz

A client has just called to tell you that he or she is getting divorced, but neither spouse has considered the financial implications. The client asks for your advice. How can you establish an orderly and effective process for addressing the challenges this couple will face—without inadvertently putting yourself at legal risk? If your legal relationship is with only one spouse, your job might be relatively straightforward. But in the more likely case you represent both spouses, you’ll probably need to decide if you will continue to work with one spouse or the other or if you will refer them elsewhere during the divorce process.

Jennifer Failla, CDFA™

Principal, Strada Wealth Management

Toll Free: 866.526.7098

Email: info@stradamanagement.com

Actionable Steps When Buying a Home Is a MUST in Divorce

While purchasing a home during a divorce is possible, it’s generally a difficult process. In our firm, we recommend that you avoid it, and wait to purchase a home after you are divorced with a decree in place. But what if you have to get into a new home during the divorce process?

While purchasing a home during a divorce is possible, it’s generally a difficult process. In our firm, we recommend that you avoid it, and wait to purchase a home after you are divorced with a decree in place. But what if you have to get into a new home during the divorce process?

As I mentioned in my previous article, Qualifying for a Mortgage - OK - What About While Waiting for the Decree?, if you don't have three years of income or individually-filed tax returns that show you qualify for the mortgage, this can be complicated. Assuming that you have had counsel, with agreement from your attorney and financial professional to proceed with purchasing a home, there are several things you need to do right away:

Establish where the funds are coming from.

For example, if you live in a community property state like Texas, marital funds are joint. This means that if you use marital funds to make a big down payment on a home, your soon-to-be ex-spouse may have a legitimate claim on the realty you're purchasing.

Therefore, establish where the down payment money will come from. If possible use your own funds that you have kept separate throughout the marriage. Your soon-to-be ex-spouse won’t have a legitimate claim on the real estate.

Note: If you're purchasing a home outright, using separate funds, your solution is much simpler.

Get a Marital Settlement Agreement.

A Marital Settlement Agreement (MSA) can help you prove that a home is yours, and prevent marital claim on it by the ex-spouse. In order for the MSA to help, you must:

- Determine that you and your spouse are separated.

- Specify a date on which you separated.

- Use non-marital funds as a down payment.

Calculate your post-divorce budget.

Calculating your post-divorce budget is critical. Work with a qualified mortgage broker to help you determine what your new mortgage payment, utilities and property taxes will be on your new residence. Then you can take this information back to the negotiating table to request a division that helps you sustain it financially.

Calculate your post-divorce income.

You will need to prove to the mortgage underwriter that you can support the home in your new life. This will be based on:

- Your MSA

- Marital and non-marital funds being used for the down payment.

- Proof of how you will support the home going forward

Get court approval.

Your attorney can request court approval for the purchase of your new home. This order can protect you against claims from your ex-spouse going forward. You should give this to the mortgage underwriter, as well.

Alternatively, if your divorce is amicable, draft an agreement that indicates you're making the purchase with consent of your ex-spouse. He or she can then waive marital interest in the property.

When it comes to purchasing a new home during a divorce, we at Strada Wealth Management advise our clients to let the financial dust settle before making big decisions around purchasing a new home, but should you have to purchase a new home during the divorce process, please execute these critical actions and find advice from a fiduciary.

Are you seeking specialized financial guidance during a divorce? We can help! Contact us today at 866-526-7098.

Jennifer Failla, CDFA™

Principal, Strada Wealth Management

Toll Free: 866.526.7098

Email: info@stradamanagement.com

Update Your Risk Profile with Your Investment Advisor

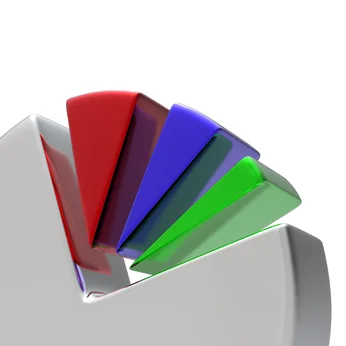

Investment professionals are responsible to help investors continually determine what level and kind of risk they are willing to take with their investments.

In order to determine a client’s risk appetite, investment professionals often ask a client to complete a risk profile questionnaire. It’s a standard financial planning form and each firm typically develops their own or uses someone else’s. These questionnaires are typically 7 to 10 questions that attempt to measure the investor’s thoughts on the risks in the marketplace and how it might affect them inside their portfolio.

Investment professionals are responsible to help investors continually determine what level and kind of risk they are willing to take with their investments.

In order to determine a client’s risk appetite, investment professionals often ask a client to complete a risk profile questionnaire. It’s a standard financial planning form and each firm typically develops their own or uses someone else’s. These questionnaires are typically 7 to 10 questions that attempt to measure the investor’s thoughts on the risks in the marketplace and how it might affect them inside their portfolio.

For example, a question might be something like, “If you lose 20% of the value of your portfolio, which of the following things might you do?

- Do nothing;

- Buy more;

- Move your money;

- Not sure what to do.”

When the client leaves the office, the investment professional has a baseline on which to ground the portfolio recommendations. They can choose investments that meet the client’s appetite for risk. However, it is important to update these questionnaires from time to time because the economy and risk factors continue to change.

In 2008, investors were nervous because the economy was experiencing real difficulty; risks were higher, appetite for risk taking actually dropped in our firm. So in 2008 - 2010 investors were answering risk questions differently than they are in 2014. We can't just file the risk questionnaires and put them away.

In our firm, we have instituted a new practice where every summer, after clients have fulfilled their tax obligations and have a good idea of where they stand financially, we ask them to reassess themselves in terms of their individual risk appetite. We tie this into their annual retirement/financial planning outlook.

We are looking into implementing a software application that will interact directly with the client. It will compare their current risk appetite to what they presently hold to see if they are aggressively investing in the market or not being aggressive enough.

We believe the risk should be reassessed at least annually; it is not good enough to take the risk questionnaire and then file it away. Investment professionals should ensure investment portfolios are continually monitored and not just perform a one-time task in order to get their compliance paperwork done.

As investors, clients who have not completed a risk appetite questionnaire for some time and who now feel differently about the markets should contact their investment professional. Clients should ask that their portfolio be reassessed to ensure their risk appetite is reflected in what they currently own.

Looking at one’s investment portfolio from a risk appetite perspective is a good thing to do and continually do over time. These are fast-moving times. We cannot be stale in our approach to the current economic environment.

Jennifer Failla, CDFA™

Principal, Strada Wealth Management

Toll Free: 866.526.7098

Email: info@stradamanagement.com

Did You Say “I Do?” Here’s How to Change Your Last Name

The most important thing to remember about changing your name is that it requires patience.

If you decide to take the name of your spouse, you will have to inform many different people and organizations. There is a certain order you should adhere to when doing this: 1. Government agencies; 2. Financial institutions; 3. Insurance companies; and 4. Cable companies, phone companies, etc; 5. Your employer

The most important thing to remember about changing your name is that it requires patience.

If you decide to take the name of your spouse, you will have to inform many different people and organizations. There is a certain order you should adhere to when doing this:

Government agencies;

Financial institutions;

Insurance companies; and

Cable companies, phone companies, etc.

Your employer

The first government agency you should contact is the Social Security Administration (“Social Security”). In our wealth management firm, we streamline the process by taking care of scheduling and accompanying our clients to the regional Social Security office. Here are some things to remember when working with Social Security:

It is necessary to make an appointment to be seen at Social Security. No walk-ins are allowed for this case.

Social Security will require a certified copy of your marriage license or decree, and they will keep it.

Please note: Most agencies and financial institutions will need to see a certified marriage license - photocopies are not enough. That is why it is important to keep at least one extra certified copy of your marriage license or decree handy.

Social Security will inform the Internal Revenue Service of your new name. This is vital because a mis-match between your name and Social Security Number could trigger a rejection on your tax return.

From there, we recommend booking an appointment - as opposed to waiting - with the Department of Motor Vehicles, in order to obtain an updated license or ID card. The updated license will make it possible to update your financial institutions, insurance companies and utility bills.

In our firm, we will take the new license and notify our custodian, TD Ameritrade, and then all of our investment accounts will be updated with your new name. Please contact us if you would like a sample form letter you can send to all your institutions.

Next there is your employer to consider. Your paychecks, W-4, elections forms, etc., all need to reflect your new name. This also gives the opportunity to review payroll deductions and make sure that your tax withholdings reflect the combined income of your new family.

Last, but certainly not least, the 3 major credit agencies - Equifax, Experian, and TransUnion - should also be informed of your new name in order to keep your credit history. I recommend checking your credit 6 months after you marry to verify your new name is reflected (see my other Blog about credit reports and what to be aware of when requesting yours). Again, we have a form letter to assist our clients and we mail the agencies for them if needed.

Getting your name changed is tedious. It is important to remember, though, that while Social Security and the Internal Revenue Service may be aware of your name change, other agencies and institutions are not. It is up to you and your financial team to stay on top of it.

Our mission is to be the trusted adviser to our clients and provide exemplary service; to bring clarity to complicated marital property division options and financial planning issues for families.

What can we help you get done?

Jennifer Failla, CDFA™

Principal, Strada Wealth Management

Toll Free: 866.526.7098

Email: info@stradamanagement.com

Qualifying for a Mortgage after Divorce -- OK -- What about While Waiting for the Decree?

When people are considering a divorce, one of the questions they often forget to ask themselves is, “How will this divorce affect my ability to qualify for a mortgage or make certain investment decisions in the future?”

Currently, we are working a case where a client has been dealing with her divorce for 3+ years, and she still does not have a divorce decree. This has prevented her from qualifying for a mortgage and making important investment decisions.

When people are considering a divorce, one of the questions they often forget to ask themselves is, “How will this divorce affect my ability to qualify for a mortgage or make certain investment decisions in the future?”

Currently, we are working a case where a client has been dealing with her divorce for 3+ years, and she still does not have a divorce decree. This has prevented her from qualifying for a mortgage and making important investment decisions.

Note:

In general, mortgage underwriters like to see 3 years of verifiable income.

Divorce isn’t the only reason a person may need to wait 3 years.

In another case, a single, young professional was disqualified for a mortgage because she switched jobs and, as a result, no longer had 3 years of verifiable income.

In another case, a client without 3 years of verifiable income, could only purchase a home if her soon-to-be ex husband cosigned. However, this would prevent the ex-husband from obtaining his own mortgage.

Moreover, since she cannot qualify for a mortgage, she needs to keep liquid cash on hand for a potential home down payment. Everything seems to be in limbo and here is our current situation:

No decree. The underwriter will not qualify her for a mortgage.

Even though we know she has the income to support a mortgage, a considerable down payment will be required because she has no credit history as an individual tax-filer.

She has been sitting on cash for a long time while looking because she cannot verify a 3-year income history yet.

This client is missing a significant market opportunity because her liquid cash is not invested.

If this client came to us 3 years ago and said, "I want to buy this $600,000 home," and she provided a $300,000 down payment, she still would not have been able to qualify because she would not have amassed the required 3 years of tax returns filed as an individual. A real conundrum, if you ask me.

Even if she had the liquidity to buy a $600,000 house outright, that money will no longer be available to invest. Instead, $600,000 would be locked up in a slowly-appreciating asset as opposed to other, more lucrative investments; the flip side is she would have no mortgage.

With this client we have played it conservatively to make the best of a bad situation, yet we can only take it so far. Now the client is between a rock and a hard place. Not only does she have to wait to get through the verifiable period (3 years of established income - whether it be alimony, distributions, her own income, etc.), but she can't make any investment decisions. Unfortunately, that can preclude a person from moving on and finding closure - which is a very tough endeavor when you're trying to transition from married life to single life.

Our firm prides itself on the various angles and approaches we take with our clients simply because every situation is unique; cookie-cutter approaches won’t succeed in this arena.

The expertise of your financial team is often the deciding factor in navigating your divorce and investments. Our knowledge comes from experience working with real people. With over 9 years of day-in and day-out case experience, we are experts in post-divorce wealth management, divorce negotiations and its financial implications. Contact us today if you find yourself between a rock and a hard place.

Jennifer Failla, CDFA™

Principal, Strada Wealth Management

Toll Free: 866.526.7098

Email: info@stradamanagement.com

My Frustration For YOU - Educate Yourself, Demand More

Since January of this year, we have been working hard to reduce allocations around long-duration bonds. With the most recent fed decision to ease quantitative support, I have paused to consider the implications to my post-divorce wealth management clients and have spent considerable time these past two weeks to further diversify the portfolio. After all, the fed expects our economy to stand on its own - how will that affect your investments?

Since January of this year, we have been working hard to reduce allocations around long-duration bonds. With the most recent fed decision to ease quantitative support, I have paused to consider the implications to my post-divorce wealth management clients and have spent considerable time these past two weeks to further diversify the portfolio. After all, the fed expects our economy to stand on its own - how will that affect your investments?

Protecting our client's money, increase yield and seek some growth is not an easy task in this current investing environment. We pride ourselves on being fee-only and offering our clients a flat fee. Lots of other financial advisors wonder why, and my response is always this:

There are three things that will eat away at our client's wealth: taxes, inflation and fees.

Those include advisory fees!

Recently, I have found some impressive investments. They seek to protect against inflation, rising interest rates, replace bond yield that is so hard to obtain and replace these days and increase portfolio diversification.

Because I am a FEE-ONLY investment advisor, I vow to not take commissions and trails from the investments I choose. I charge my client a flat rate each year for my objective investment advice. I am their fiduciary.

Investments all have fees. How do you think mutual fund companies make money? They charge different rates. Let's look at some examples:

- Class A Shares - front-end charge to you - 3% sometimes as high as 5% off your initial investment. The advisor collects that as commission and then collects a small amount each year called a trail (typically about .25%)

- Class B Shares - no front-end charge but if you sell, you will have a back-end charge assessed - that's nice.

- Class C Shares - level charge each year typically 1% paid to the advisor- not good if you plan on holding the investment for a long time.

- Institutional Class Shares - flat simple charge each year around .65%. My favorite because the advisor takes no commission or collects no trail.

EDUCATE YOURSELF

To learn more about this topic, visit Investopedia.com, which does a great job of explaining share classes further. Learning about this is important because you are ultimately responsible for knowing what you pay for your investments and why.

Back to the original point of my blog. Why am I frustrated? I want to charge my clients their flat fee and invest in strategies that meet their risk profile and are suitable to their other investments without charging them excessive fees. For this reason, I love institutional shares.

GUESS WHAT?

In order to invest in some institutional shares, you need a minimum of $1 million dollars*. Yes, $1 million dollars. How does the prudent retail investor muster $1 million dollars for one fund?

DEMAND MORE

I got to thinking. We need a fee revolution. We need consumers to demand answers and ask what they are paying and why. I feel confident that I will sort through this and find a way - either with these investments or other great investments.

Ask the hard questions:

- How do you get paid exactly?

- In how many ways are you compensated? Fees, share class fees, trails and commissions.

- How can I get my fees waived?

- How can we lower the minimum requirement so I can participate in a reasonably priced investments?

You deserve to know and it is your right as an investor.

For independent financial and investment advice, feel free to contact us. We offer a "second look" on your portfolio on an hourly fee basis. 866-526-7098; www.stradamanagement.com

My best, Jennifer

*The advisor can ask how to waive the class share fees. The consumer should ask about this!

**There are other great investments out there that don't cost as much and fund companies will work with advisors to reduce minimums. Exchange Traded Funds (ETF) are a great option as well.

Jennifer Failla, CDFA™

Principal, Strada Wealth Management

Toll Free: 866.526.7098

Email: info@stradamanagement.com

Allowance for Children: More Than a Lesson on Paper

I thought I had a theory regarding allowance, until I had to put my theory into motion with my own child.

What I learned was that my husband had his own theory and shockingly, I had mine. This caused conflict as to how we wanted to present allowance to our nine-year-old son.

My philosophy is that allowance should not be paid for normal work and chores, but for work or activities done above the basic chores: make bed, pick up toys, put clothes and dishes in appropriate places. I’ve always explained to the family that we are 4 people, each participating members in our home, each with an equal responsibility to take care of it.

I thought I had a theory regarding allowance, until I had to put my theory into motion with my own child.

What I learned was that my husband had his own theory and shockingly, I had mine. This caused conflict as to how we wanted to present allowance to our nine-year-old son.

My philosophy is that allowance should not be paid for normal work and chores, but for work or activities done above the basic chores: make bed, pick up toys, put clothes and dishes in appropriate places. I’ve always explained to the family that we are 4 people, each participating members in our home, each with an equal responsibility to take care of it.

My husband’s philosophy is that allowance should be paid for basic chores, but he was very open-minded, understood my philosophy, and was willing to compromise. The next subject was which chores were eligible for allowance credit.

When I first said, “Wash the car once a week,” my husband disagreed. He felt it was too big of a job, and what if we were travelling one weekend? Should my son lose his ability to do his chore and earn his allowance? More conversations like this ensued. Finally our debates led me to a parenting specialist.

“My husband and I have agreed that we are not going to give an allowance for basic chores, but we are torn as to what to assign and for how much.” I also explained how we had determined that my son was to do 4 things per day, 7 days a week, to earn his allowance. The parenting specialist nearly fell off her chair laughing, saying, “I can’t even remember to do 4 things in a day. That’s too much for your son. Too much pressure.” She guided me to 4 things a week.

So my husband and I came up with a list of chores that I think are really creative, different and unique to our household that will allow our son to accomplish them even when we travel:

Write a good sentence in Italian.

Write a good sentence in Spanish.

Write a complicated math problem and solve it with Papa’.

Read a book to your brother and write the title in your journal.

Then we got to the subject of how much. My husband said, “Ten dollars,” and I said, “Five.” My husband also wanted $3 to go to charity. We are in complete disagreement. I go back to the parenting specialist, who pretty much fell off her chair again, saying, “What is it that we’re trying to teach? I think $10 a week is fine, but nothing to charity for now. Let’s pick the lesson we’re trying to impart on the child.”

Even as a money manager, I really have to think through the process and consider the family’s needs in determining the chores, the amount and delivering the message to my child. Everyone has different ideas, but even in your own financial planning, it’s important to walk through the options. Throw everything on the table; no idea is a bad idea.

What options are you leaving off the table in your own home?

Since then, ironically, my son has forgotten about requirements and the reward behind them. I am sure this subject will arise again. When it does, I will be ready. Until then, I still enjoy reading the books to Nicola and having them help me wash the cars.

Jennifer Failla, CDFA™

Principal, Strada Wealth Management

Toll Free: 866.526.7098

Email: info@stradamanagement.com